Pension modelling, monitoring & analytics

FutureCost

Unlock the future impact of your decisions

FutureCost is a suite of robust, web-based tools designed for corporations, multiemployer plan sponsors, and public plan entities that are faced with the short- and long-term risk inherent in plan sponsorship, volatility in key costs and financial measures, and long-term contribution needs.

Ask tough questions. Expect good answers.

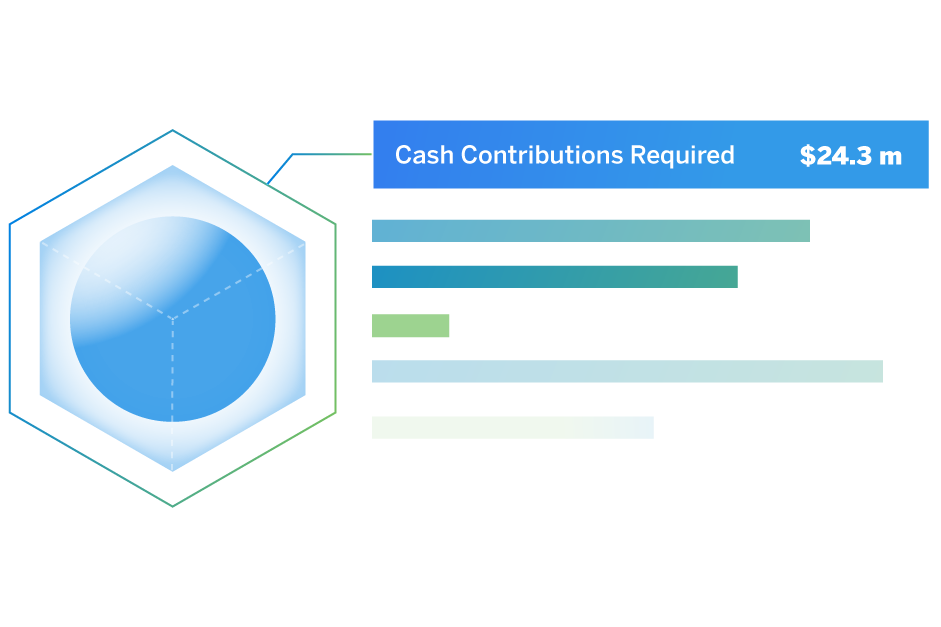

FutureCost projects the assets and liabilities of a retirement plan into the future, providing key insights into plan contribution requirements, funded status, accounting expense, and potential impacts to your balance sheet.

Project any “what-if” scenario you can imagine

- What if liability discount rates fluctuate?

- What if asset returns are different than expected?

- What if we make an investment strategy change?

- What if we come up with a different contribution strategy?

- What if we make a benefit change?

- What if the covered population changes?

Daily updates to your phone

Estimate daily discount rates, funded status, and various projections sent via email or text message to you or as many team members as you’d like. These estimates and projections are also accessible on the web.

Daily updates give you the power to reallocate assets at opportune times, be notified of unexpected future requirements, and closely track the status your defined benefit plan(s).

Ready to share

FutureCost stores and saves important plan-related information like plan documents or actuarial valuation reports for future reference in one convenient location.

Best of all, FutureCost makes even the most complex results easy to understand, in a clean, fresh interface, with output that’s easy to share with your executive team.

Customise and run projections in advance of key internal meetings, incorporating charts and graphs from FutureCost into presentations. Use FutureCost to model scenarios in real time for future discount rates, inflation, investment returns, and contribution patterns.

Want to learn more about FutureCost?

Industry insight

Episode 16: How pensions in America have changed (and should change again)

The American pension plan is in flux, but not for the first time in U.S. history; this episode discusses why it’s a turbulent time for retirement security and what the next generation of pension plans could – and should – look like.

Products related to FutureCost

Pension Performance Dashboard

A complete solution for analysing unpaid claims liabilities, combining our industry-leading stochastic modelling tools with a robust suite of deterministic reserving tools.

Milliman Daily Pension Tracker

The Milliman Daily Pension Tracker provides an accurate diagnosis of pension plans daily, allowing for plan sponsors to make prompt investment decisions to de-risk pension liability.

GASBhelp

GASBhelp™ is an online tool that provides an accurate, low-cost method of valuing non-pension post-employment benefits for organizations that are required to comply with GASB 74 or 75 and that have fewer than 100 plan members.

Services related to FutureCost

Defined benefit plan administration

Maximise the value of pension benefits to participants using our decades of experience, flexible software tools, and disciplined process.

Defined benefit plan consulting

Meet your goals and business objectives in the face of constantly shifting markets and regulations.

Frozen plan services

Implement a comprehensive, strategic approach to ensure participant benefits are paid while reducing costs.

GASB75 compliance

Adapt to the increased reporting frequency and detail required by new regulations with expert guidance.

Mergers & acquisitions

Succeed with purchase and divestment of healthcare and insurance assets, whether a single line of business or an entire company.

Milliman Sustainable Income Plan

Get the best of both worlds with an innovative retirement plan design combining the benefits of defined benefit and defined contribution plans.

Multiemployer services

Address the issues raised by shifting demographics, increasing regulatory demands, and steadily rising costs.

Nonqualified plans

Review compensation plans for 409A compliance and communicate effectively with affected employees.

Retiree medical

Fund and manage retiree medical and post-retirement benefit programs effectively and meet financial disclosure requirements.

Total retirement outsourcing

Simplify retirement plan administration while enhancing employees’ understanding and value of their retirement program.